Providing Best Mortgage Services

Down Payment Assistance MD

WANT TO BUY A HOUSE AND NEED HELP WITH THE DOWNPAYMENT?

Discover How Easy It Is To Buy A Home In Maryland With Little Or No Money Down Using Federal, State, Or Municipal Down Payment Programs For MD Homes.

Providing Best Mortgage Services

Down Payment Assistance MD

WANT TO BUY A HOUSE AND NEED HELP WITH THE DOWNPAYMENT?

Discover How Easy It Is To Buy A Home In Maryland With Little Or No Money Down Using Federal, State, Or Municipal Down Payment Programs For MD Homes.

Maryland home buyers can get down payment assistance to cover your down payment and closing costs from a variety of sources nationwide.

- 99% success rate

- Professional Experts

- quality service

- World-wide Clients

Ready to Make Your Homeownership Dream a Reality? Let Down Payment Assistance Lead the Way

You Can Get A Home

Maryland home buyers can get down payment assistance to cover your down payment and closing costs from a variety of sources nationwide.

How Much Can You Get?

Where’s The Money?

Federal, State, and Local Housing Finance Agencies, Non Profits, Lenders, Community Action Programs, and various other institutions serving Maryland home buyers.

We can inspire and offer different services

Renovations Loans are allowed for FHA, Conventional, VA or USDA Financing for borrower to finance home improvements in a purchase or refinance of an existing home.

Happy Customers

We Are Here To Help You

We are an education focused lender. Our staff is available to help your clients every step of the way. Below are a few of the educational opportunities we have implemented:

Have a unique situation? Just give me a call. I will assist with financing solutions to guide clients in selecting the best loan product for their financial goals.

Make it Your Dream

Parturient montes nascetur ridiculus mus is maecenas neque in feugiat elementum lacus risus.

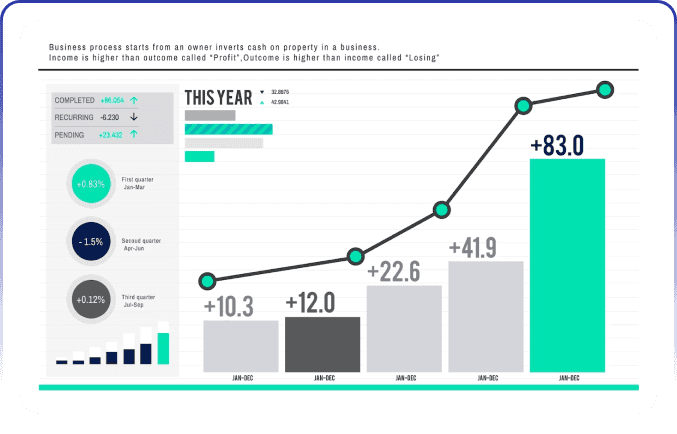

Our complete case study worldwide in a year

more then 10+ years of experience

We don’t like surprises! When we issue a pre-approval letter, we’re confident that we will close.

Frequently Ask & Questions

How Many Down Payment Programs Are Available In Maryland?

The number of down payment programs can fluctuate because there are federal, state, county, municipal, and private down payment grant programs available. Some down payment programs have budget limits, some have expiration dates. New programs get introduced on a regular basis. We match you with the down payment programs you qualify for and best meet your financial need.

How Do You Qualify For Down Payment Grants?

Each program and participating lender may have different credit score requirements, income levels, etc. It’s best to review all factors in qualifying for down payment money. Give us a call now or complete the secure online form to see how much down payment money you can get.

Can You Qualify For Down Payment Grants With Poor Credit?

Yes, We can work with many buyers who have credit scores as low as 600. There are many programs available to review or help you clean up bumps or bruises on your credit.

What Type of Mortgages Qualify For Down Payment Assistance?

Many types including FHA, VA Loans, USDA, UHC and most Conventional loans. Call now or complete the secure form to see how much down payment assistance you can get.

Our Experienced Consultant

Peoples Talk About Us

Our Latest Blog & News

Trusted By Top Companies